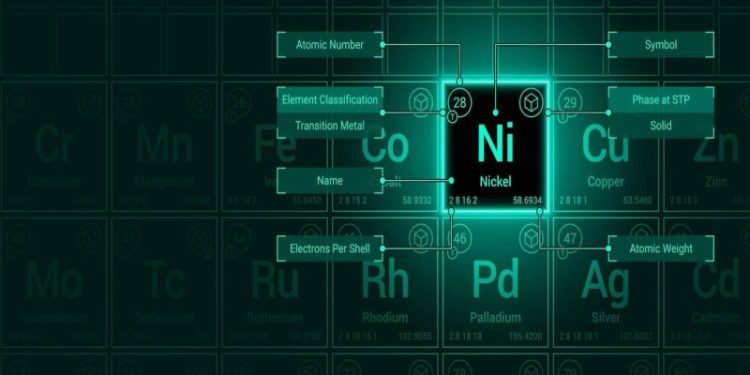

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.

Three-month nickel on the London Metal Exchange (LME) hovered near US$17,900 per metric ton, recovering from a mid-week slump but still up roughly 7 percent on the week and close to a 19-month high.

The pause followed a dramatic surge Wednesday (January 7), when prices jumped more than 10 percent in their biggest one-day gain in over three years, driven by heavy Chinese buying and renewed concern over production curbs in Indonesia, the world’s dominant supplier.

The rally reversed two years of pressure on nickel, which had been weighed down by Indonesia’s rapid expansion of mining and processing.

That flood of material weighed on prices and dented enthusiasm for nickel’s role in electric vehicle batteries, where demand growth has been slower than initially anticipated.

This week’s shift, however, further highlighted how sensitive the market remains to policy signals from Jakarta and shifts in speculative positioning.

Indonesia’s policy signals jolt the market

At the center of the latest volatility are expectations that Indonesia may tighten mining quotas under its annual RKAB approval process.

Mining Minister Bahlil Lahadalia said that the government would reduce output quotas to support commodity prices and boost state revenues. Indonesia produced about 70 percent of the world’s nickel last year, giving policymakers outsized influence over prices.

Those concerns were reinforced when Vale (NYSE:VALE) subsidiary PT Vale Indonesia temporarily halted mining at its Pomalaa and Bahodopi operations after failing to secure approval for its 2026 production plan.

The company said output during the stoppage would run at roughly 30 percent of normal capacity, though it added that the delay “will not disrupt overall operational sustainability” and that approvals were expected “in the near future.” Operations at Vale’s flagship Sorowako mine continue.

Deputy Mining Minister Yuliot Tanjung confirmed that the approvals were “currently being consolidated” but declined to specify the final quota levels.

The uncertainty amplified short-covering in the nickel market, helping push prices toward US$18,800 per metric ton earlier this week before momentum cooled.

Meanwhile, inventory levels remain a critical counterweight. Stocks registered with the LME have surged more than 300 percent since early 2025 to around 275,600 metric ton, with a further 112,000 metric ton sitting off-warrant and potentially available to the market.

That buffer has limited the durability of rallies, even as prices respond sharply to headline risk.

Regulatory scrutiny adds pressure on supply

Regulatory scrutiny beyond Indonesia is also shaping the market’s longer-term outlook.

In Europe, the European Commission has launched a Phase II investigation into the proposed US$500 million sale of Anglo American’s (LSE:AAL,OTC:NGLOY) nickel business to China-backed MMG (OTCPK:MMLTF), citing concerns over supply security for the bloc’s stainless steel industry.

EU competition chief Teresa Ribera said regulators will examine whether the transaction “could jeopardise continued and reliable access in Europe” to ferronickel supply.

MMG said it would continue to work with regulators and expressed confidence that it could address the commission’s concerns, while Anglo American said it believes European customers would support its continued role as a marketer of ferronickel if the deal proceeds.

The Commission has set March 20, 2026 as the deadline for a final decision.

Capital flows target nickel assets

Alongside volatile spot-market trading, longer-term capital is continuing to target nickel and other critical minerals through dedicated investment vehicles.

Appian Capital Advisory and the International Finance Corporation, a member of the World Bank Group, have launched a new US$1 billion partnership focused on developing critical minerals, metals, and mining projects in emerging markets.

The partnership’s first investment is in Atlantic Nickel’s producing Santa Rita nickel-copper-cobalt project in Brazil. The investment is a co-investment alongside Appian to advance the mine’s transition to underground operations.

Santa Rita, located in Bahia state, is expected to ramp up production to approximately 30,000 metric tons per year of nickel equivalent and has a projected mine life exceeding 30 years. The asset is owned by Atlantic Nickel, a wholly owned affiliate of Appian.

For now, nickel’s steadier tone suggests the market is recalibrating after an explosive move. With prices still well above late‑2025 levels but inventories rising and policy signals remaining fluid, the next leg of the market is likely to hinge on enforcement rather than demand.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.