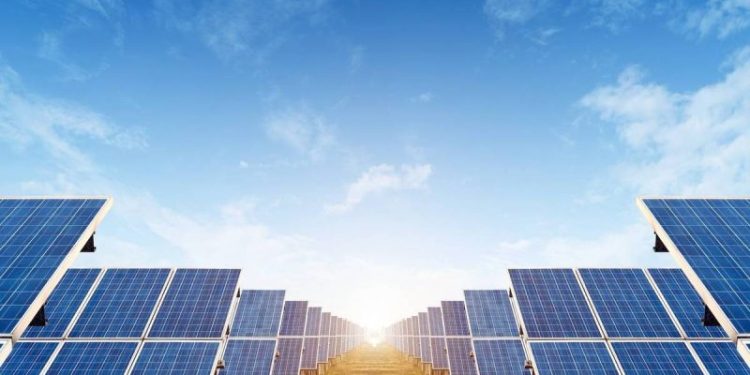

The solar industry is turning to base metals and innovation to bypass the soaring silver price.

Silver’s exceptional electrical and thermal conductivity make it a critical material in the production of photovoltaics (PV). However, record-high prices are forcing key solar industry players to find more cost-effective alternatives.

In a September 2025 report, BNEF analysts note that silver represents about 14 percent of the total cost of production for solar panels, up from 5 percent in 2023. At the time, silver was trading in the US$42 to US$46 per ounce range.

Since then, the white metal’s price has exploded, hitting an all-time high of US$93.77 on Wednesday (January 14). That’s double the level it was in September, and a nearly 200 percent increase from the year before.

In an industry already fraught with intense competition, such a large leap in the price for a major component is unsustainable. In response, top manufacturers in China such as LONGi Green Energy Technology (SHA:601012) are turning to base metals and technological innovations to help manage solar panel input costs.

Solar panel makers bypassing silver

China dominates the global solar PV industry, representing more than 80 percent of worldwide manufacturing capacity across the supply chain, including polysilicon, wafers, cells and modules.

In early January, Bloomberg reported that starting in Q2, LONGi Green Energy is planning to start mass producing solar cells using base metals instead of silver in an effort to reduce costs.

Di Giacomo believes that because LONGi Green Energy is one of the solar industry’s technological leaders, its move away from silver marks a significant turning point for the sector.

Bloomberg notes that the company has joined the ranks of other Chinese solar manufacturers looking to sidestep silver’s price volatility. In December, JinkoSolar Holding (NYSE:JKS), which is headquartered in China, but listed in the US, said it was looking to roll out large-scale production of solar panels using base metals. Additionally, smaller firm Shanghai Aiko Solar Energy (SHA:600732) is producing 6.5 gigawatt solar cells without silver.

“Other major manufacturers, such as JinkoSolar and AIKO Solar, are also exploring silver-free technologies or solutions that minimize the use of this metal,” said Di Giacomo. “The convergence of efforts among leading players suggests this is not an isolated trend, but rather a structural shift in how solar panels are designed and manufactured.”

Is copper a viable alternative to silver?

Copper is the prized favorite among the base metals for swapping out silver.

While both metals have seen unprecedented price rallies on the back rising industrial demand from clean technologies and artificial intelligence, silver maintains an enormous premium over copper. Currency, the price of a troy ounce of silver is trading at about 22,000 percent higher than a troy ounce of copper.

“Although its conductivity is slightly lower, copper is far more abundant, cheaper and supported by a more diversified supply chain,” stated Di Giacomo. “These characteristics make it an attractive option for an industry seeking to scale production without exposure to bottlenecks in critical raw materials.”

The red metal may be a great electrical conductor, but it doesn’t match silver’s capabilities. There’s also the tendency for copper to oxidize and degrade, testing the long-term viability and reliability of copper-based solar components. For those reasons, subbing in copper presents technical challenges for PV makers.

One area of concern for replacing silver with copper is the high temperatures needed in the fabricating process for tunnel oxide passivated contact (TOPCon) cells, the technology currently dominating the solar panel industry.

This might not be as big an issue for LONGi Green Energy, which manufactures back-contact (BC) cells. The technical processes for adapting copper to this new type of solar cell architecture is much simpler compared to TOPCon cells.

“New generations of copper-metallized cells are achieving efficiency levels increasingly close to those of traditional silver-based models,” said Di Giacomo. “In some cases, improvements are even being observed in mechanical strength and module durability, key factors for long-term solar installations and operation under demanding environmental conditions.”

BC cells have also been shown to generate more power from the same amount of sunlight compared to TOPCon cells. A white paper from renewable energy advisory company Rinnovabili states that field data indicates that BC modules are capable of producing up to 11 percent more energy over their lifetime compared to TOPCon technology.

How will substitution impact silver?

In a November 2025 report, the Silver Institute reported that industrial silver demand is projected to drop by 2 percent in 2025 to 665 million ounces. One of the contributing factors in the decline is an approximate 5 percent decrease in silver demand from the solar industry, even though the number of global PV installations set a new record high for the year. This is “due to a sharp drop in the amount of silver used in each module,” according to the firm.

“A sustained reduction in solar sector silver demand could alter market dynamics,” warned Di Giacomo.

However, at this point it’s too early to tell. For one, TOPCon technology is expected to account for 70 percent of the market in 2026. The cost of manufacturing BC cells is not expected to reach parity with TOPCon cells until the end of the decade, said Molly Morgan, senior research analyst at CRU Group, as reported by pv magazine.

“That’s why we believe we might see a coexistence of the two technologies in the 2028 to 2030 timeframe,” she said.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.